A sole proprietorship balance sheet is a financial statement that provides a snapshot of a business financial position at a specific point in time.

The balance sheet presents a summary of what a company owns its assets what it owes its liabilities, and the residual value to shareholders its equity at a particular moment.

Balance Sheet main three components

- Assets

- Liabilities

- Equity

Assets:

Assets are usually categorized into two main types: current assets and non-current assets. Current assets are those expected to be converted into cash or used up within one year, such as cash, accounts receivable, inventory, and prepaid expenses.

Non-current assets, also known as long-term assets, include items like property, plant, equipment, intangible assets, and long-term investments.

Liabilities:

Liabilities are also divided into current liabilities and non-current liabilities. Current liabilities are debts that are due within one year, such as accounts payable, short-term loans.

Non-current liabilities, also known as long-term liabilities, such as long-term loans, bonds payable, and deferred tax liabilities.

Equity:

This represents the residual interest in the company's assets after deducting its liabilities.

In other words equity is what remains for the owners or shareholders of the company after all debts have been paid off.

The balance Sheet fundamental Equation:

Assets = Liabilities + Equity

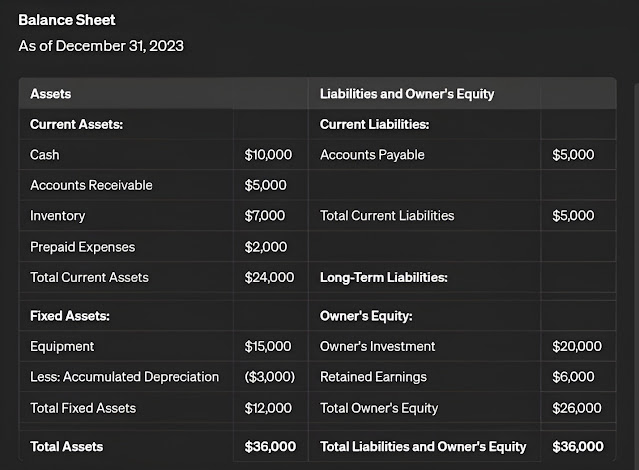

Here a simple example of a balance sheet for a sole proprietorship:

|

- Current assets include cash accounts receivable inventory and prepaid expenses.

- Fixed assets include equipment, with accumulated depreciation deducted from its value.

- Current liabilities include accounts payable.

- Long-term liabilities are not included in this example but could be added if applicable.

- Owner's equity includes the owner's initial investment and retained earnings.

This balance sheet provides a snapshot of the sole proprietorship's financial position at a specific point in time.

Read More : How to Done your Sales funnels

%20(1).jpeg)